BHP & Department of Defence Partnership.Get to know our business Get to know our business.Indigenous peoples and BHP Indigenous peoples and BHP.Our Global Inclusion and Diversity Council.

Inclusion and diversity Inclusion and diversity.Recruitment process Recruitment process.What you're looking for What you're looking for.ESG Standards and Databook ESG Standards and Databook.Tailings storage facilities Tailings storage facilities.Ethics and business conduct Ethics and business conduct.Carbon offsets and natural climate solutions.Value chain (Scope 3) greenhouse gas emissions.Operational (Scope 1 and 2) decarbonisation.Portfolio analysis and capital alignment.Sustainability approach Sustainability approach.Consensus estimates Consensus estimates.Shareholder information Shareholder information.ESG and sustainability ESG and sustainability.Investor presentations and events Investor presentations and events.Climate change engagement, disclosure and reporting.Financial results and Operational Reviews.Financial results and Operational Reviews Financial results and Operational Reviews.Corporate governance Corporate governance.The future is clear The future is clear.Board and management Board and management.Operating ethically Operating ethically.Why our work matters Why our work matters.In addition, you should carefully read all of a fund’s available information, including its prospectus and most recent shareholder report before purchasing mutual fund shares. Fees reduce returns on fund investments and are an important factor that investors should consider when buying mutual fund shares.įor more information on mutual funds, please read our brochure on Mutual Funds and ETFs: A Guide for Investors. Different mutual funds may also be subject to different risks, volatility, and fees and expenses. Each may have a different investment objective and strategy and a different investment portfolio. Some mutual funds are index funds and other are actively managed. There are many varieties of mutual funds, including, stock funds, bond funds, and money market funds. In addition, the investment portfolios of mutual funds typically are managed by separate entities known as investment advisers that are also registered with the SEC. Mutual funds are registered with the SEC and subject to SEC regulation.Investors sell their shares at the current NAV per share, minus any fees the fund may charge at redemption, such as deferred sales loads or redemption fees. This means that when mutual fund investors want to sell their fund shares, they sell them back to the fund or to a broker acting for the fund.

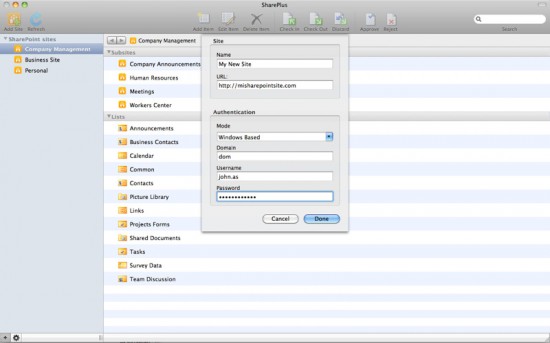

SHAREPLUS INVESTMENT PLUS

The price that investors pay for mutual fund shares is the fund’s current net asset value (NAV) per share plus any fees that the fund may charge at purchase, such as sales charges or loads. Investors cannot purchase the shares from other investors on a secondary market, such as the New York Stock Exchange or Nasdaq Stock Market. Investors purchase shares in the mutual fund from the fund itself, or through a broker for the fund.Mutual funds generally sell and purchase their shares on a continuous basis, although some funds will stop selling when, for example, they reach a certain level of assets under management.Here are some of the traditional and distinguishing characteristics of mutual funds: Exchange-traded funds (ETFs) are generally also structured as open-end funds, but can be structured as UITs as well.Ī mutual fund continuously pools money from many investors and invests the money in stocks, bonds, money market instruments, other securities, or even cash. The other two types of investment companies are closed-end funds and unit investment trusts (UITs). An open-end fund is one of three basic types of investment companies. The Laws That Govern the Securities IndustryĪ mutual fund is an open-end investment company or fund.Researching the Federal Securities Laws Through the SEC Website.Structured Notes with Principal Protection.Smart Beta, Quant Funds and other Non- Traditional Index Funds.Mutual Funds and Exchange-Traded Funds (ETFs).Publicly Traded Business Development Companies (BDCs).Stock Purchases and Sales: Long and Short.Pay Off Credit Cards or Other High Interest Debt.Public Service Campaign (new) – “Investomania”.Required Minimum Distribution Calculator.

SHAREPLUS INVESTMENT PROFESSIONAL

0 kommentar(er)

0 kommentar(er)